Compliance is a growing concern, particularly for publicly traded companies or organizations in regulated industries. Auditors require complete transparency into how CapEx decisions were made, who approved them, and whether they followed internal financial controls. Our software allows you to develop accurate budgets and forecasts, enabling you to allocate resources effectively and manage risk.

What is the best project portfolio management software for capex?

Before funds are committed, requests are evaluated for feasibility, alignment with strategic goals, and financial impact. A strong approval process involves multiple layers of review by finance, operations, and executive teams. CapEx management software, on the other hand, automatically records every user action, offering full traceability for audit purposes. This reduces audit risk and supports compliance with internal controls, SOX, and other financial regulations.

Capex360® Features: Streamlined Capital Expenditure Management

Prioritizing projects across a large portfolio can be challenging, especially in the absence of a CapEx management system. Capital budgeting, project approvals, and capex management solution forecast changes are all dependent on capital allocation decisions. You need a solid CapEx management solution that helps make informed decisions on capital allocation.

CapEx management platforms bring these stakeholders together on one shared system. Team members can collaborate on justifications, upload documentation, leave comments, and track progress in real time. One of the greatest advantages of CapEx software is real-time visibility into every investment initiative.

Talk to a workflow expert

- Leadership teams gain access to visual dashboards, customized reports, and alerts, helping them monitor CapEx performance against KPIs and spot bottlenecks early.

- Because you can’t determine meaningful variances to a budget without granular project-level details.

- Finario is the first and only purpose-built, enterprise capital planning software solution.

The first step towards efficient CapEx management is aligning your investment strategy with your organization’s overarching business objectives. Start by thoroughly understanding your company’s goals, growth plans, and market dynamics. Evaluate how capital investments can support these goals, such as expanding production capacity, upgrading infrastructure, or exploring new markets. By aligning CapEx decisions with business objectives, you can ensure that every investment contributes directly to the company’s success.

Our core solutions for capital project success

CapEx software creates a secure, traceable environment for managing large financial commitments. Every action—submission, approval, modification, or cancellation—is recorded with timestamps and user IDs, ensuring full audit trails. Spreadsheets are prone to human error, especially when formulas are complex or the dataset is large. A single incorrect formula, accidental deletion, or misplaced decimal point can distort an entire capital plan or misrepresent project performance. Our software simplifies the entire Capex process, from initial budget planning to final approval, making it easier for your team to collaborate and stay on top of deadlines.

Enter our CapEx software, Budget Room, which streamlines the budgeting process and fosters stakeholder collaboration with its user-friendly interface. IQX CAPEX is an end-to-end, flexible, and customizable CapEx process solution. We are the leading SAP-based capital expenditure software solution on the market, delivering an immediate ROI to organizations and finance teams around the world.

- CapEx management software introduces standardized templates, workflows, and reporting structures, making it easier to manage capital planning across multiple departments, locations, or subsidiaries.

- Requests are submitted and sent through the workflow based on delegation of authority, and users can easily track the progress of their requests and see where they are in the approval path.

- Managing CapEx isn’t an isolated activity—it needs to align with overall budgeting, forecasting, procurement, and financial reporting systems.

- It’s easier to see the scope and breadth of each project in context and eliminate bad choices.

- By automating the CapEx request and approval process, organizations reduce cycle times, strengthen compliance, and improve the quality of investment decisions.

Create and compare “what-if” scenarios to see the impact of potential decisions before you make them. Finario provides the flexibility you need, and is ideal for bottom-up budgeting and zero-based budgeting. While the line between CAPEX and OPEX can seem fuzzy—and some purchases will contain elements of both—it’s important to keep these categories distinct.

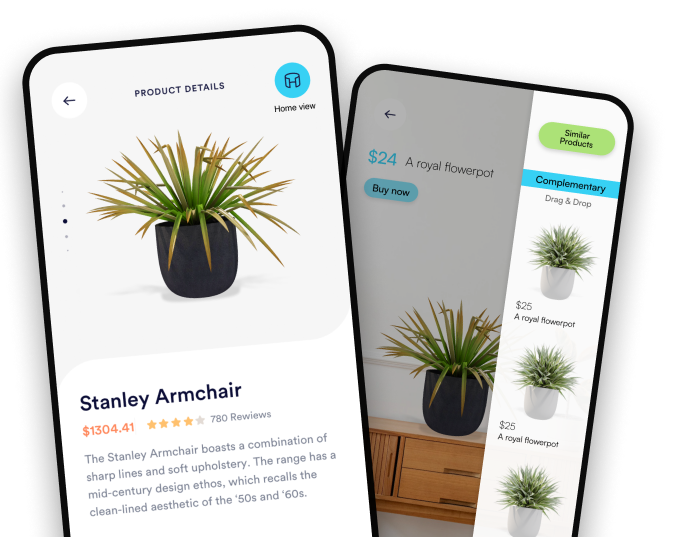

Cflow is a no-code workflow automation platform designed for finance, procurement, and operations teams to digitize and control every aspect of the CapEx lifecycle. With intuitive drag-and-drop tools and robust reporting, Cflow makes it easy for enterprises to create, manage, and scale capital approval workflows without writing a single line of code. The best project portfolio management software for capex includes tools like Monday.com and Wrike, which provide robust features for managing multiple projects and capital expenditures. Some of the best capex management software options include SAP, Oracle, and IBM Planning Analytics. These tools offer comprehensive features for tracking and managing capital expenditures.

With automated workflows, smart approval routing, and deep SAP-integration, IQX CapEx software ensures your capital projects maximize strategic outcomes and ROIC. Our CapEx management solutions cater to the needs of finance, engineering, and IT departments, helping manage capital expenditures from budgeting and approval to project completion and beyond. Capital planning involves more than just budgeting for large purchases—it requires rigorous analysis, structured approvals, and long-term tracking of capital investments. Without the right tools, organizations face delays, cost overruns, and poor alignment between strategy and spending. CapEx management software addresses these challenges by digitizing and centralizing every step of the capital planning lifecycle.

We are the leading SAP-integrated capital expenditure solution on the market, delivering an immediate ROI to finance teams around the world. This fragmented approach can substantially slow down attempts at transformation. The transparency that comes with having a single source of truth ensures faster, more objective and more informed decision making. A best-in-class platform also provides the ability for different stakeholders to work in parallel rather than in queue. Say goodbye to paperwork and signatures; submit CapEx requests effortlessly.

Establish key performance indicators (KPIs) to evaluate project milestones, budget adherence, and expected returns. Regularly review and compare actual results with projected outcomes, and promptly address any deviations or issues. Implementing a centralized project management system can help streamline monitoring, enhance visibility, and facilitate timely decision-making.

Some businesses have seen as much as a 25% reduction in their year-on-year portfolio spending. Capital expenditure (CAPEX) is money that a business invests in acquiring or upgrading assets with a useful lifespan of more than one year. These fixed assets include physical properties like land, machinery and equipment, as well as some intangibles, like computer software.

Establishing a robust approval process is crucial to ensure that all capital expenditure requests are thoroughly evaluated and aligned with the organization’s investment criteria. Define clear guidelines, criteria, and thresholds for investment proposals, and establish an effective governance structure involving key stakeholders and decision-makers. This process should involve comprehensive documentation, including detailed business cases, financial forecasts, and risk assessments. By implementing a structured approval process, you can enhance accountability, transparency, and consistency in CapEx decision-making.