It can help traders hedge against price changes or speculate on future movements. A professional forex trader gets their income from trading on the currency market. In contrast to beginners, earnings from the FX market tend to be the primary source of income for professionals. To become a professional, your technical analysis needs to be excellent. Most top performers focus on price pattern analysis to identify and capitalize on market trends. However, people often ask, “do you really need to use indicators?

If the twelve winning trades generated profits of $2,000, your average profit would be $2,000/12, or $166. These signals will tell you whether to open a short or long position for the respective pair, at what price, and how to adjust your Stop Loss and Take Profit levels. Novice traders can also take advantage of various educational articles, videos and webinars that can greatly shorten their learning curve. Algorithmic trading, also known as algo trading or automated trading, is the use of computer programs and algorithms to execute trades in the financial markets. These algorithms are designed to analyse market data, identify trading opportunities, and execute trades based on a set of predefined rules and instructions.

Effective Trading Strategy

Technical analysis of price patterns and volume signals can help investors succeed at 24/7 trading if they understand the limitations of this data during low liquidity periods. However, there’s no guarantee that you’ll make a profit due to the volatile nature of currency markets. Smart, knowledgeable, experienced traders—and even beginners at forex trading—will have a better chance to profit if they follow the few simple principles described above. Part-time traders with little or no experience are advised to start trading small amounts of currency.

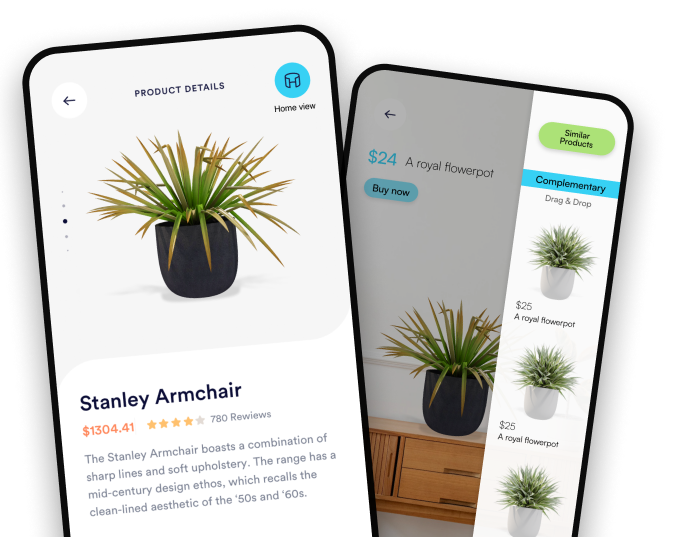

Platforms

The idea is to borrow an asset in the expectation of its price decreasing. Closing a short position will then “give back” the borrowed asset for a profit (if prices go down) or a loss (if prices end up rising). So, any reasonable strategy starts with identifying market patterns and inefficiencies.

You can use all of these platforms to open, close and manage trades from the device of your choice. The ask price is the value at which a trader accepts to buy a currency or is the lowest price a seller is willing to accept. The bid price is the value at which a trader is prepared to sell a currency. All transactions made on the forex market involve the simultaneous buying and selling of two currencies. Forex trading allows for round-the-clock trading in various global sessions, distinct from stock markets that operate through central exchanges.

- Some platforms like Interactive Brokers offer a wide range of assets for trading outside market hours, but may only be appropriate for more experienced investors.

- Enjoy free trading practice onProRealTime Paper Trading Simulator.

- Minor and exotic pairs can be popular, especially for those interested in emerging markets.

- However, it’s still different from the forward market and futures market because the options market offers higher leverage and requires more precise timing.

- To avoid being swept away by the market when you first start out, it is strongly recommended that you first train with a no-obligation-risk-free demo trading account.

- You can creat a demo account, download and set up your preferred trading platform software, and start trading!

The forwards and futures markets are more likely to be used by companies or financial firms that need to hedge their foreign exchange risks. Unlike the U.S. stock exchange, which can be located on Wall Street in New York City, the world’s forex markets have no physical buildings that serve as trading venues. Instead, they operate via connected trading terminals and computer networks. Market participants are institutions, financial product banks, commercial banks, and retail investors worldwide. The main markets are open 24 hours a day, five days a week (from Sunday, 5 p.m. ET, until Friday, 4 p.m. ET). Currencies are traded worldwide, but most of the action happens in the major financial centers.

Practicing on a demo account helps you test different trading strategies and understand how currency pairs behave during various market hours. It’s also the ideal environment to place trades, set stop-loss and take-profit orders, and manage positions effectively. Forex trading offers the potential for significant profits but also carries substantial risks.

Major currency pairs

The Trading Station platform from FXCM is another top provider for retail forex professionals. The system offers advanced charting capabilities, a breadth of indicators, and trade automation. The platform is available via web or to download on desktop and mobile devices. The required duration to achieve expertise in forex trading individually may vary based on your dedication to the process of learning.

Basic Forex Trading Strategies

In finance, technical analysis is a security analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. If the price of the currency you are buying goes up from the time you bought it, you will have made a profit. Currencies are always traded in pairs—the value of one unit of currency doesn’t change unless it’s compared to another currency.

- External factors, such as war or natural disasters, can also have an impact on the prices in the forex market.

- If you prepare properly and you are ready to learn, forex trading can be a great way to create a steady income.

- If there’s high demand for a particular currency but low supply, its value will likely rise.

- It is not about random decision-making, which is almost always counterproductive.

- Searching on the internet for terms you haven’t seen yet in your adventure will also greatly assist your assimilation and use of trading vocabulary.

Being a forex trader could be an interesting and rewarding career choice if you desire to work in a fast-paced setting where the job is always changing. We go over the stages to becoming a forex trader in this article. Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation.

Popular options include MetaTrader 4, MetaTrader 5, as well as our own FXTM Trader. Forex is how to become a forex trader traded on the forex market, open to buy and sell currencies 24 hours a day, five days a week. This market is used by banks, businesses, investment firms, hedge funds and retail traders. Forex trading entails speculating on currency prices to earn potential profits. By trading currencies in pairs, traders predict the rise or fall in value of one currency against another.

A trainer or reference book with tips on forex trading may be helpful for new traders to read. Although traders may choose to develop their concepts and approaches alone, expert counsel might be useful in the beginning. This could be done independently or on behalf of financial entities like huge banks, hedge funds, and investment funds. Experts advise trading only the USD/EUR pair for the part-time trader who has a limited trading window. This pair is most frequently traded and there’s an abundance of readily available information on these currencies across all forms of media. Advanced traders may also explore additional markets, timeframes, and strategies.

An illustration will help you understand forex trading.

But certification indicates to your clients that you comprehend trading. Spreads and fees, while seemingly small, do add up and can significantly affect profitability, especially for frequent traders. Understanding the hurdles of the forex market is crucial for anyone considering trading currencies.

You should first get a solid education in the foundational concepts of Forex by taking my free beginners Forex course. Computer abilities can make it simpler to navigate trading platforms and programs if you trade online. The capacity to manage their trades using spreadsheets and other applications is advantageous for forex traders as well. Forex traders have the option of trading alone or using an automated trading system.

These products may not be suitable for everyone and you should ensure that you understand the risks involved. A trader looking to maximize profitability and be successful will become skilled in technical and fundamental analysis. This is to ensure that their trading decisions are well-informed. Such stats do not exist for successful traders as experience levels, deposits, and trading styles vary. Countries like the U.S. have sophisticated infrastructure and robust regulation of forex markets by organizations such as the National Futures Association and the CFTC. Developing countries like India and China have restrictions on the firms and capital to be used in forex trading.